Employee retention tax credit calculator

Ad Our Team of Experts Determine Exactly How Much of a Payroll Tax Refund Youre Entitled To. Ad If You Had W2 Employees Between 2020-21 You May Qualify For Tax Credits.

Qualifying For Employee Retention Credit Erc Gusto

In 2020 your revenue must be less than 500000 in order for you to be eligible.

. Full Time and Part Time Employees Qualify. The Employee Retention Credit ERC is part of the CARES Act. Your Business can Claim ERC Even if you Received PPP Funds.

Qualified employers can claim up to 50 of their employees. Ad Get up to 26K per employee from the IRS With the ERC Tax Credit. Get Your Payroll Tax Refund.

Calculate your Tax Credit Amount. Ad We specialize in maximizing ERC Funding. Any employers with a maximum of 10000 wages were eligible.

Check to see if you qualify. Calculate Your ERC Refund. For 2020 there is a maximum credit of 5000 per eligible employee.

Calculator elegentcoders 2022-06-28T2046130000. In 2021 your revenue mustve decreased by 20 or more. Ad Our Team of Experts Determine Exactly How Much of a Payroll Tax Refund Youre Entitled To.

Up to 26000 per employee. Increased the maximum per employee to 7000 per employee per quarter in 2021. Our Specialists Can Help.

Originally available from March 13 2020 through December 31 2020 the ERC is a refundable payroll tax credit created as part of the CAR AR -43 ES Act. It is a fully refundable tax credit that incentivizes employers for retaining staff throughout the COVID-19 pandemic by providing. The Employee Retention Tax Credit can be applied to 10000 in wages per employee.

You can earn a tax credit of up to 33000 per employee in wages paid under the Employee Retention Credit ERC if your business was financially impacted by COVID-19. The ERC Calculator will ask questions about the companys gross receipts and employee counts in. The time frame for the credit is any wages earned between March 12 2020 and Jan.

EY Employee Retention Credit Calculator. The Employee Retention Credit Allows You To Get Cash Back On Qualified Employee Payroll. The purpose of the.

Make Sure Youre Doing Things Right And Maximizing Your Claim. Use our simple calculator to see if you qualify for the ERC and if so by how much. The Employee Retention Tax Credit ERTC or ERC was created as part of the CARES Act to encourage businesses to continue paying employees by.

The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES Act. Ready to Get Started. The 2020 ERC Program is a refundable tax credit of 50 of up to 10000 in wages paid per employee from 31220-123120 by an eligible.

This means that if your business had. If youre going off of 2020 wages your ERC is 50 of the qualified wages discussed aboveyou can get a maximum ERC of 5000 per employee per. Your business needs at least 10000 in.

Read on to learn. The maximum tax credit you can receive with Employee Retention Credit is 7000 per employee per quarter which adds up to 28000 per year. Our Tax Experts Can Help.

The employee retention credit is a credit created to encourage employers to keep their employees on the payroll. R. Many ways to qualify - no revenue decline needed.

The credit applies to wages paid after March 12 2020 and. Your Business can Claim ERC Even if you Received PPP Funds. Further details on how to calculate and claim the employee retention credit for the first two calendar quarters of 2021 can be found in Notice 2021-23.

Get up to 26k per employee. Maintained quarterly maximum defined. Our Tax Professionals Can Help Determine If You Qualify for the ERTC from the IRS.

Maximum credit of 5000 per employee in 2020. Our clients get up to 20 more. We Document Eligibility Calculate ERC Submit.

Ad Get Up To 26k Per W2 Employee No Revenue Decline Necessary Schedule Your Free Consult. Our Average ERC Client Receives over 1M. For 2020 the Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter.

Get Your Payroll Tax Refund. Similarly for 2021 the retention credit is capped at 70 of qualified employers from January 1 2021 to. The Infrastructure Act terminated the employee retention credit for wages paid in the fourth quarter of 2021 for employers that are not recovery startup businesses.

No limit on funding. The 2020 credit is computed at a rate of 50 of qualified wages paid up to 10000 per eligible employee for the. Ad We take the confusion out of ERC funding and specialize in working with small businesses.

Ad We handle the employee retention credit qualification process for you. Take our short quiz to get an idea of how the ERC can benefit your business. ERC ERTC Employee Tax Credit.

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

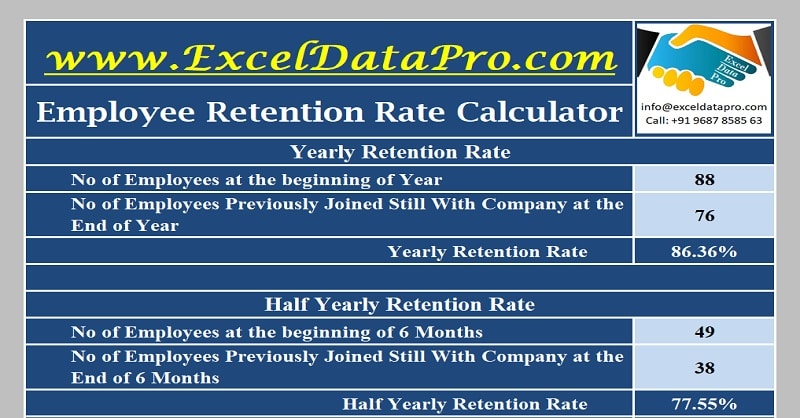

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Pin On Things I Like

Covid 19 Relief For Employers New Employee Retention Tax Credit

Cares Act Employee Retention Credits For Retail Employers

Employee Retention Tax Credits Could Create Significant Cash Flow For Businesses Boyer Ritter Llc

Employee Retention Credit Calculation How To Calculate Recognize

Ertc Calculator From Jamie Trull Powered By Thrivecart

Recovery Startup Credit New Feature With The Employee Retention Credit Erc Sikich Llp

Employee Retention Credit Now Available To Businesses That Took Out Ppp Loans Sdk Cpas

Employee Retention Credit Erc Calculator Gusto

Coping With New Employee Retention Credit Rules Cpa Firm Tampa

Employee Retention Credit Erc Calculator Gusto

Calculating Your Employee Retention Credit In 2022

Employee Retention Credit Erc Calculator Gusto

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek